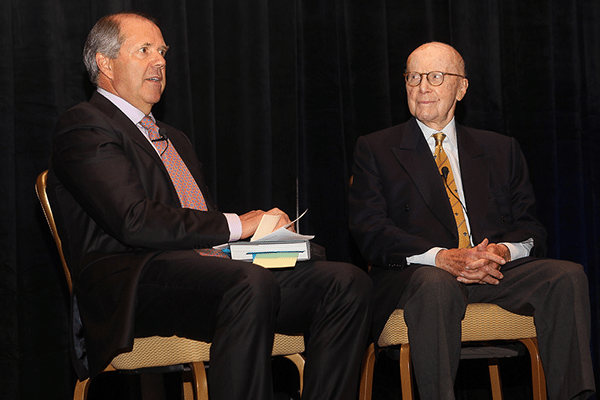

Over 300 investors, owners and developers attended the third annual Marcus & Millichap / IPA Multifamily Forum Houston for a full day of programming along with a networking breakfast, lunch and post-conference cocktail reception. Attendees benefitted from the insights, successes, and failures of top multifamily developers, investors and owners as they discuss the latest trends, challenges and innovations in the Greater Houston Region. Participants also had the opportunity to hear from one of real estate’s most visionary risk takers, Gerald Hines, Founder and Chairman of Hines who was interviewed by another Houston heavy hitter, Ric Campo, Chairman and CEO of Camden Property Trust.

The Marcus & Millichap / IPA Multifamily Forums across the U.S. bring together over 5,000 multifamily owners, investors, managers and developers to create an in-person marketplace for learning, discovery, networking and deal making. The sessions address the major issues affecting the apartment and condo industries today, and the networking allows multi-housing principals to meet, talk and source deals and investment capital.

Recap

Photos

Keynote Speakers

Meet the Speakers

Swapnil Agarwal

Founder & Managing Partner

Nitya Capital

Kevin Batchelor

Senior Managing Director

Hines

Matthew Berger

Vice President of Tax

National Multifamily Housing Council

Abe Bhimani

Founding Partner

Mosaic Residential

Stephanie Bryson

Managing Partner

Stellar Equity Management

Jennifer Campbell

Associate Director

Institutional Property Advisors

Chad Collins

Director

Marcus & Millichap Capital Corporation

Jeb Cox

Senior Managing Director – Austin & Houston

Mill Creek Residential

John Faulk

VP – Land Acquisitions

Aspen Heights

Jeffrey Fript

First Vice President Investments

Marcus & Millichap

Kevin Kirton

Chief Executive Officer

Buckhead Investment Partners

Ash Kumar

Founder

Ashford Communities

David Luther

FVP & District Manager

Marcus & Millichap

Jesse Levine

Principal

Verde Communities

Madison Marceau

Executive Vice President

Lynd Development

Robert Martinez

Founder

Rockstar Capital Management

Bryant Nail

EVP – Multifamily

PM Realty Group

Shayn D. Robinson

Principal

Darrow Multifamily Properties

Jacob Saour

Director – Investments

Cortland Partners

John Sebree

FVP & National Director,

Multifamily

Marcus & Millichap

Joe Shahda

Principal

Shahda Investments

Mark Cantrell

President

Cantrell McCulloch

Michael D’Onofrio

Managing Director

Engineered Tax Services

Gary Goodman

Senior Vice President of Acquisitions

Passco Companies

John Hammond

President & CEO

Riverway Title

Richard Hoffmann

President & Owner

Anterra

Jay Porterfield

Principal – Agency Lending

PGIM Real Estate Finance

Agenda

8:00 AM – Exhibit Hall & Dining Area

Registration, Networking Breakfast & Exhibit Hall Opens

9:00 AM – General Session

Multifamily State of Market: National vs. Houston

Presented by:

- John Sebree, FVP & National Director, Multifamily, Marcus & Millichap

9:40 AM – General Session

There Will Be (Many) Apartments: Update from the City’s Most Active Developers

The city of Houston saw its fair share of tough times in 2016. The steep drop in oil prices and the oversupply of Class A residential properties being built created a ripple effect that is still being felt. However, many believe that 2016 was the city’s rock bottom, and the only way to go now is up. As Houston heads into 2017, what are leading developers doing to confront the market?

- On Your Downtime: While new development is stalled, what are key players in the market doing to prep for the upside?

- Grabbing the Spotlight: With the amount of product in the pipeline, what are some strategies that owners and developers are using to lease and market their new buildings?

- The Elephant in the Room: How is affordability playing a role in rent prices for upcoming product?

- The Trump Effect: How will the new administration’s trade and immigration policies impact apartment developers?

Moderator:

-

-

- Jennifer Campbell, Associate Director, Institutional Property Advisors

-

Speakers:

-

-

- Kevin Batchelor, Senior Managing Director, Hines

- Jeb Cox, Senior Managing Director – Austin & Houston, Mill Creek Residential

- John Faulk, VP – Land Acquisitions, Aspen Heights

- Kevin Kirton, Chief Executive Officer, Buckhead Investment Partners

-

10:25 AM

Networking Break

10:55 AM – Featured Presentation

National Multifamily Housing Council

Presented by:

- Matthew Berger, Vice President of Tax, National Multifamily Housing Council

- John Sebree, FVP & National Director, Multifamily, Marcus & Millichap

11:25 AM – General Session

Barriers to Entry: Real Estate Capital Markets Sources and Challenges for Houston Deals

With so much supply in the pipeline and the city’s economy taking a downturn, the past year saw lenders hesitant to enter the Houston market. However, many are anticipating a recovery period during 2017, indicating that the tides could begin to shift towards more availability of capital. As optimism grows, where should multifamily developers look to for financing opportunities? If not Houston, what markets are lenders excited about?

- Sticker Shock: How will mezzanine debt change in the next year?

- Moving Target: Changing borrowing requirements

- From Beyond the Lone Star: The role of foreign equity in today’s Houston deals

- Let’s Be Real: Adjusting equity investors’ expectations

Moderator:

-

-

- Chad Collins, Director, Marcus & Millichap Capital Corporation

-

Speakers:

-

-

-

- Gary Goodman, Senior Vice President of Acquisitions, Passco Companies

- Madison Marceau, Executive Vice President, Lynd Development

- Bryant Nail, EVP – Multifamily, PM Realty Group

- Jay Porterfield, Principal – Agency Lending, PGIM Real Estate Finance

- Jacob Saour, Director of Investments, Cortland Partners

-

-

12:10 PM – General Session

Management and Operations: Boosting Your NOI In a Restricted Economic Environment

With the loss of energy-related jobs and the resulting oversupply of Class A product, it’s difficult to argue that the oil bust of 2016 has not had a strong impact on Houston. Multifamily owners and operators, many of whom are working twice as hard to maintain occupancy and prepare their staff for what’s to come, are feeling the effects as well. What strategies are the leading players in multifamily operations using to push back against the constraints of the Houston market?

-

-

- Apples and Oranges: Tenant expectations from Class A to Class C

- Not So Smart House: The best strategies for incorporating technology into your buildings

- On the Ground: What are the best methods to empower and strengthen the skills of your building’s employees?

- Circling the Wagons: Maintaining occupancy and rent levels in a challenging time

-

Moderator:

-

-

- Jeffrey Fript, First Vice President Investments, Marcus & Millichap

-

Speakers:

-

-

-

- Stephanie Bryson, Managing Partner, Stellar Equity Management

- Mark Cantrell, President, Cantrell McCulloch

- Ash Kumar, Founder, Ashford Communities

- Robert Martinez, Founder, Rockstar Capital Management

-

-

12:55 PM

Networking Lunch & Exhibits

1:00 PM – Lunch Workshop

New Trump Administration Updates: Federal, State and Local Energy & Specialty Tax Incentives

The presentation is designed to provide New Trump Administration Updates to Federal, State and Local Energy & Specialty Tax Incentives and provide clarity to the design, qualification and certification process to maximize results and cost savings on purchases, renovations, improvements and new construction projects. During this presentation, you will be able to understand how to capture and best utilize Cost Segregation, Energy Tax Credits (like 179D for commercial buildings and 45L tax credits for residential and multi-family projects) on a local and national scale.

-

-

-

-

- New Trump Administration Tax and Energy Incentives Updates for the property owner, developer, investor, finance and broker communities.

- Overview of available Energy Tax Credits and recently extended 179D, 45L and R&D Federal and State credits available for the design of energy-efficient buildings.

- Recognize Opportunities and capture benefits for Property Owners, Investors, Architects, Engineers, CPA’s, Real Estate Attorneys, Energy Consultants and Contractors.

- Understand how these new tax laws and related strategies available can become an additional value-added service to your clients, as well as a revenue stream for your firm.

- Additional related benefits and tax strategies including Cost Segregation, Property Tax Appeals, Energy Audits and related savings.

-

-

-

Presented by:

-

-

-

-

- Michael D’Onofrio, Managing Director, Engineered Tax Services

-

-

-

1:45 PM – General Session

Not Getting Any Younger: Today’s Effective Strategies and Opportunities in Value-Add

Although the impact of deep concessions in the luxury space is starting to be felt in some Class B markets, value-add has still fared well during the oil slump. These properties have become easier to come by as many investors bypass Houston during this time of slower economic growth. However, redevelopment comes with its own set of obstacles and best practices, some that may not be obvious to those who are new to this space. What strategies are leading players in the value-add market using to yield the most ROI?

-

-

-

-

- One Man’s Garbage Is Another’s Treasure: Opportunities in mismanaged properties

- Penciling Out: Economics of successful value-add today

- Across the Spectrum: The case for mixed income value-add in Houston

- Holding the Purse Strings: Where should developers look to for the financing of B, B- or C properties

- A Change of Heart: Looking to opportunities in covered land play

-

-

-

Moderator:

-

-

-

-

- John Hammond, Partner, Riverway Title

-

-

-

Speakers:

-

-

-

-

- Swapnil Agarwal, Founder & Managing Partner, Nitya Capital

- Abe Bhimani, Founding Partner, Mosaic Residential

- Richard Hoffmann, President & Owner, Anterra

- Jesse Levine, Principal, Verde Communities

- Joe Shahda, Principal, Shahda Investments

- Tony Whitaker, President & CEO, FSI Construction Services

-

-

-

2:30 PM – General Session

Afternoon Keynote: Ric Campo of Camden Property Trust and Gerald Hines of Hines

Presented by:

-

-

-

-

-

- Ric Campo, Chairman & CEO, Camden Property Trust

- Gerald Hines, Founder & Chairman, Hines

-

-

-

-

Venue

Marcus & Millichap / IPA Multifamily Forum Houston

Thursday, May 11, 2017

8:00 AM – 3:00 PM

JW Marriott Houston

5150 Westheimer Road

Houston, Texas 77056

Hotel Information

We have a room block at the JW Marriott Houston for the night of May 10th. The discounted rate is $159+tax per night. You can make your reservation by calling 1-800-228-9290 or 713-961-1500 and mentioning “Marcus & Millichap/IPA Multifamily Forum May 2017“. The cutoff for making reservations is April 18th.

Attendees

-

-

-

-

-

- – Accu-Crete

- – ACORE Capital

- – Adara Communities

- – American Bay

- – Anterra

- – ApartmentData.com

- – Arcadia Capital

- – Arch-Con

- – Ares Management

- – Ascension

- – Ashford Communities

- – Aspen Heights

- – Auburn Regal

- – Audubon Communities

- – AVR Group

- – Bay Paradise

- – Bedford Cost Segregation

- – Brandy Investments

- – Breeze Realty

- – Bridge Partners

- – Brookfield

- – Buckhead Investment Partners

- – Callisonrtkl

- – Camden Property Trust

- – Cantrell McCulloch

- – Capstone Real Estate Services

- – Casoro Capital

- – Chicago Title Houston

- – Chipster Properties

- – City Bank Texas

- – City Construction Partners

- – Comfort Systems USA

- – Commercial Insurance Solutions

- – Company

- – Cortland Partners

- – CoStar

- – CRG Properties

- – Crystal & Co.

- – Crystal and Company

- – CVAL Group

- – Daiwa House

- – Dakota Enterprises

- – Dryden Street Capital

- – Engineered Tax Services

- – EXP Realty

- – First American Title

- – FSI Construction

- – Gaia Real Estate Investments

- – Gatesco

- – Gensler

- – GeoScience Engineering & Testing

- – Giering Investments

- – Gold Quest Group

- – Green Bank

-

-

-

-

-

-

-

-

-

- – Greenway Equity Management

- – GWR Management

- – Hensley Lamkin Rachel

- – Hilltop Residential

- – Hines

- – HMBC Capital Partners

- – Hoar Construction

- – House + Partners Architecture & Planning

- – Humphreys & Partners Architects

- – Hunt

- – Indus Management Group

- – Insitutional Property Advisors

- – Interstate Restoration

- – Interurban Companies

- – Investar USA

- – Investors’ Property Services

- – ITEX Group

- – Jansen International

- – JCD Interests

- – JLB Partners

- – Juniper Investments

- – Keener Investments

- – Kendu-Bay

- – Kimley-Horn

- – KKR

- – KSW Homes

- – Lamppost Capital Management

- – LDG Development

- – Lily Capital Mgt.

- – Linkwood Park Apartments

- – Littell Properties

- – LMI Capital

- – LNC Properties

- – Locker Solutions

- – Lynd

- – Mainspring Partners

- – Marcus & Millichap

- – Marx|Okubo Associates

- – Midway

- – Midway Companies

- – Mill Creek Residential

- – Morgan Group

- – Mosaic Residential

- – MW Builders

- – National Multifamily Housing Council

- – National Realty Consultants

- – Nitya Capital

- – NorthGulf ZSP

- – Nova Asset Management

- – Old RepublicTitle

- – Page

- – Paradigm Tax Group

- – Partner Engineering and Science

-

-

-

-

-

-

-

-

-

- – Passco Companies

- – Pepper Lawson Construction

- – PGIM Real Estate Finance

- – PM Realty Group

- – PointOne Holdings

- – Powers Brown Architecture

- – Praxis Capital

- – Presidium

- – Primary Solutions

- – Prime Finance

- – Private Investor

- – Private Owner

- – Property Steward

- – QRH

- – Ratcliff Companies

- – Raybec Investments

- – Rentlytics

- – ResMan

- – RETC

- – RH Management

- – Rhodes CRE

- – Rialto Capital

- – Riverway Title

- – Rockstar Capital Management

- – Ryan LLC

- – Shahda Investments

- – Shreve Land Constructors

- – Sonoma Housing Advisors

- – Stellar Equity Management

- – Stewart Title Guaranty Co.

- – STG Design

- – Tarantino

- – The Hanover Company

- – The ITEX Group

- – The NuRock Companies

- – Timberline Management Company

- – Tom Berry REI

- – Trident Realty Partners

- – Trinity Property Consultants

- – Trivium Investments

- – UL Coleman

- – US Bank

- – USAA Real Estate Company

- – Valbridge Property Advisors/Teel Co.

- – Valet Waste

- – Verde Communities

- – Vintage Communities

- – WA Development

- – WAK Management

- – Waterton

- – Whitehurst 9911 Partners

- – Windsor Property Management

- – Yad Investments Limited

- – ZT Wealth

-

-

-

-

Conference Chairs

Founded in 1971, Marcus & Millichap is a leading commercial real estate brokerage firm focusing exclusively on investment sales, financing, research, and advisory services, with more than 1,700 investment professionals in offices throughout the United States and Canada. The firm has perfected a powerful property marketing system that integrates broker specialization by property type and market area; comprehensive investment research; a long-standing culture of information sharing; relationships with the largest pool of qualified investors; and state-of-the-art technology matching buyers and sellers. In 2016, the firm closed 8,995 transactions with a sales volume of approximately $42.3 billion.

Institutional Property Advisors (IPA) is a unique platform created to support the needs of institutional and sophisticated private investors. IPA is centered around a select national network of institutionally qualified brokerage professionals and supported by a robust technology platform and highly regarded research. IPA’s unique combination of real estate investment expertise, industry-leading technology, superior support services and acclaimed research will offer customized solutions for the acquisition and disposition of institutional multifamily properties and portfolios.

Since its formation in 1989, Anterra has provided individuals and financial institutions a full range of multifamily services including property management, construction supervision, acquisition advisory and due diligence. For the last three years, Anterra has specialized in multifamily repositioning. During that time, Anterra has completed repositioning on over 4,000 units with capital improvements exceeding $30,000,000. Recent projects have involved property rebranding, significant exterior and interior improvements and amenity enhancements coordinated with rental increases, expense reduction and resident profile upgrades. Since 2010, Anterra has provided acquisition advisory services that resulted in purchases by clients of seven properties totaling 1,600 units with a combined purchase price of over $100,000,000. Anterra currently manages 10,000 units of apartments in all the major cities in Texas and has offices in Dallas and Austin.

Engineered Tax Services (ETS) is a nationally licensed engineering firm with extensive experience in engineering-based specialty tax services yielding substantial tax incentives for companies of all sizes. ETS is one of the only qualified engineering firms with its own Professional Engineers, LEED Accredited Professionals, Certified Public Accountants, and Licensed Contractors on staff. ETS provides a full range of specialty tax incentives for real estate professionals including Cost Segregation, 263(a) Repairs vs. Capitalization, Disposition Studies, 179D EPAct, 45L, Utility Rebates and Refunds, Energy Audits, Modeling, and LEED Certifications. ETS averages over $44 million per month in refunds for clients, equating to hundreds of studies nationally. ETS is committed to providing the highest level of service and attention to detail in order to realize maximum benefits and ensure compliance of IRS guidelines. For more information, please contact us Engineered Tax Services at 800-236-6519 or visit www.engineeredtaxservices.com.

FSI Construction was founded in early 1997 & went into full operation under the leadership of Al Robinson & Tony Whitaker. FSI entered the multifamily & commercial markets as a foundation & concrete repair contractor. FSI has built a solid reputation for quality work by striving to provide excellent service to its customers and is widely known throughout the apartment industry as an industry leader. For over a decade, the company has grown by strategically expanding its line of services under the carefully crafted FSI Construction brand. FSI leaders have become integral parts of the Houston, Texas & National Apartment Associations, serving in numerous leadership roles and supporting the apartment industry through sponsorships, outreach & PAC contributions. FSI was presented with the prestigious HAA Presidential Award, a rarity for supplier members. FSI was most recently awarded the prestigious HAA Supplier of the Year title for 2009.

Jansen International is one of the largest loss consulting firms in the United States. We offer insurance claim adjusting and consultative recovery services to commercial businesses and homeowners throughout the United States and abroad. A network of strategically placed offices addresses the needs of clients in a variety of industries and businesses. A full listing of the breadth of our experience can be found in the client section of our website. Our firm is geared to handle commercial property losses on a moment’s notice throughout the United States, and our homeowner division handles property losses ensuring that families’ lives are put back together as quickly and completely as possible following fires, floods and other catastrophic events.

Since 1979, Jansen International has earned its reputation for leading business owners and families through the process of proper claim preparation and presentation. Our recovery plan mobilizes a professional staff of licensed adjusters, structural estimators and contents accountants who work together in solving the numerous challenges associated with recovery. Outsourcing the management of your first-party property claim will result in a maximized and expedited claim recovery.

Mark and Tim Cantrell, along with Bobby McCulloch, founded Cantrell McCulloch (CMI) in December 2000. In their opinion, most traditional tax consulting firms were not thorough enough in their evaluations and overall level of service. From the beginning, CMI succeeded in reducing property taxes for clients that had unsatisfactory results using larger, more established firms. Even clients that appeared to have low assessments found that CMI often reduced valuations significantly in the first year of representation. Today, many well known and respected multifamily companies trust CMI with their property tax issues. In 2013, CMI represented over $5 billion in property assessments for multifamily alone, resulting in actual tax savings to our clients of over $20 million. Bobby, Mark and Tim have a unique multifamily background involving brokerage, ownership, management, construction, appraisal, and accounting allowing them the ability to determine the optimum approach to pursue when negotiating with the appraisal district. And their motivational philosophy is evident with each CMI consultants compensation being directly related to the results they generate.

Since its founding in 1980, LYND has acquired nearly $1.8 billion of multifamily transactions across 20,000+ apartment units. The bulk of these investments have been acquired with capital from large discretionary funds combined with co-investment capital from joint venture partners. The LYND method to successful investing has always depended on using its skilled acquisition professionals to cover targeted investment markets. The principals believe that opportunities are uncovered by diligent market coverage, long-standing relationships (with other property owners, developers, and banking professionals), synergies through LYND’s vertically integrated management platform, and an excellent reputation of acquisition performance. Markets and opportunities move very fast. LYND has demonstrated the ability to look ahead of capital market trends and demand drivers.

Since 1998, Passco Companies, LLC has operated throughout all market conditions and cycles. The company has placed over $1.4 billion of investor funds and acquired over $3.2 billion in multifamily and commercial real estate in the United States. Since its inception, Passco Companies has become a recognized provider of investment opportunities in real estate projects. Passco Companies is directed by a team of dedicated senior real estate professionals whose experience in the business averages 34 years, and who, collectively, have acquired over $30 billion in investment real estate projects.

PGIM Real Estate Finance, the commercial mortgage business of PGIM, the trillion-dollar global investment management business of Prudential Financial, Inc. (NYSE: PRU), is an international full-service, commercial and multifamily mortgage finance business with more than $88 billion in assets under management and administration as of Dec. 31, 2016. Leveraging a 140-year history of real estate finance, the company offers one of the most comprehensive lines of real estate finance products and originates loans for Fannie Mae DUS:registered:, Freddie Mac and specialized affordable housing programs; FHA; Conduit; Prudential’s general account; and other institutional investors. For more information, please visit http://www.pgimref.com.

Riverway Title Company provides comprehensive title insurance, underwriting and closing services to the commercial and residential real estate industries and is committed to providing the highest quality title solutions regardless of the size or complexity of your real estate transaction. We value our customer relationships and continually work to maintain them through consistent, responsible and knowledgeable service. Our dynamic team is comprised of highly-qualified, responsive closing professionals with a wealth of experience spanning decades in the title industry. It is our goal to create a culture of support and teamwork among our clients and our associates.

Get Involved in 2018!

Conference Producer:

Olga Rodriguez

(646) 862-6128

olga@greenpearlevents.com

Registration:

Scott Milliken

(646) 862-9912

scott@greenpearlevents.com

Sponsorship & Exhibiting:

Adam Kolanko

(646) 783-3955

akolanko@greenpearlevents.com